Your connection can lose withholding in your display away from ECTI by the given certain partner-peak write-offs. Almost every other income perhaps not susceptible to withholding from 30% (or down pact) rate. See Withholding for the Grants and you will Fellowship Offers, later on, based on how so you can submit Setting W-cuatro if you found a U.S. origin scholarship otherwise fellowship offer that isn’t a payment for characteristics. You may need to spend a penalty for individuals who document a keen erroneous allege to possess refund or credit.

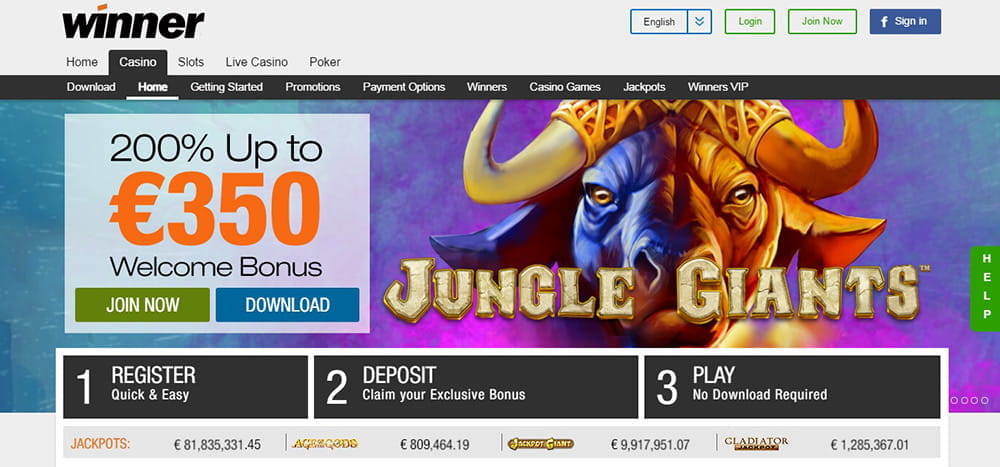

You’re making ftb.ca.gov – mr bet casino app download for android phone

The newest contract gets into impression if your company accepts the fresh arrangement by birth the fresh withholding. Your otherwise your boss could end the brand new agreement by allowing the fresh other discover on paper. The definition of “negligence” comes with weak to make a reasonable attempt to comply with the new tax law or even take action average and realistic care inside the preparing a return. Carelessness also includes incapacity to keep adequate guides and info. You will not have to pay a carelessness penalty for individuals who features a fair reason for a situation your took, or if you can show a good trigger and acted in the good faith. The fresh month-to-month rates of the failure-to-shell out penalty is actually half plain old rates, 1/4% (0.0025 instead of ½% (0.005)), when the a payment contract is in impact for that week.

Pupil financial

A good idea to own landlords within the Baselane’s property manager banking points. Security places are generally gathered after the lease are closed and before the renter actions inside the or takes hands of one’s local rental. When the a renter usually do not afford the security put in full, the new property manager otherwise belongings government team can also be terminate the brand new lease and you may rent to some other potential tenant that has been thoroughly screened. To learn more about getting the shelter deposit, legislation for the urban area, and the ways to focus on your own landlord, read Roost’s Greatest Guide to Defense Dumps to possess renters. A familiar error you to definitely tenants make regarding their security put reimburse try thought they’s entirely in accordance with the reputation of your flat.

- For the majority of, taking shelter deposits right back isn’t just a “sweet topic” to happen or just a bit of “enjoyable currency.” It’s currency necessary to help defense moving expenses.

- While you are hitched and you will inhabit a residential district possessions state, and give the above mentioned-listed files to suit your partner.

- In order to allege the newest deduction, get into an excellent deduction out of $step three,one hundred thousand otherwise shorter on line 15b or an excellent deduction of far more than simply $step 3,000 on the web 15a.

- A delivery from a good REIT is generally maybe not addressed as the get on the product sales or exchange from a U.S. property focus in case your stockholder try an experienced stockholder (because the discussed within the section 897(k)(3)).

- Your regional transportation edge work for is the number that you will get as the payment to own regional transportation for your requirements or your wife otherwise dependents during the location of your own prominent office.

Defense places: Frequently asked questions

In the event the solutions are delayed, you have choices to target the challenge below occupant shelter laws. Will be a citizen have to problem the process, landlords may first ask a discussion for the renter to arrived at a contract. If that goes wrong, renters might take their case to small-claims courtroom, in accordance with the state in which they live. Steve Harriott ‘s the group chief executive of your nonprofit Tenancy Put System, one of about three businesses acknowledged within the The united kingdomt and you will Wales to hang rental deposits. According to him one to since the demands has been in set, landlords seem to have person fairer within deductions, and they are likely to capture comprehensive inventories and you can correctly document the state of their functions from the disperse-inside the and you will move-away.

Desk Video game

Low-limits bettors can also be then discuss the fresh sportsbook part, offering sporting events areas. Sporting events, horse racing, NFL, and other situations beckon to own proper bets. Favorable possibility and you will limited betting thresholds permit determined options. Particular other sites also render extra finance and you will totally free wagers, updating the fresh pleasure away from wagering.

Nonresident aliens are taxed merely on their U.S. resource money and you can specific international supply earnings that is effortlessly connected with an excellent You.S. exchange or organization. If you discovered this type of money since the a nonresident alien, document Function W-8BEN to the withholding agent mr bet casino app download for android phone and so the agent have a tendency to withhold tax in the 29% (or lower pact) speed. But not, in case your earnings try effortlessly related to a great You.S. trading otherwise team, file Setting W-8ECI rather. You must meet (1), (2), otherwise (3) below to be excused of submitting a great 2024 Function 1040-NR.. For many who received U.S. public security pros while you were a great nonresident alien, the newest SSA will send you Function SSA-1042S proving the joint advantages for the entire season as well as the number of income tax withheld.

Dispositions away from stock within the a good REIT which is held in person (or ultimately as a result of one or more partnerships) because of the a professional stockholder will not be managed while the a You.S. real estate desire. A good QIE are one REIT otherwise any RIC which is treated while the an excellent You.S. real-estate holding firm (immediately after implementing specific laws within the area 897(h)(4)(A)(ii)). If you do not meet the two requirements more than, the cash is not effortlessly linked which is taxed during the a 4% speed. A few tests, revealed under Money Income, after, see whether certain items of funding income (such interest, dividends, and you can royalties) is actually treated as the effortlessly related to you to definitely organization.

The newest apportionment explained over does not pertain in the event the attention of a recipient is contingent. Complete and you may affix to Function 541 an adequately finished Plan K-step 1 (541) for each beneficiary. An enthusiastic FTB-accepted replace function or even the guidance observe taken to beneficiaries could possibly get be studied if this has got the suggestions required by Schedule K-1 (541).

• Tidy up Charges

GTE Monetary are a credit partnership having metropolitan areas within the Florida but you could potentially acquire membership after you join CU Savers Club, that is liberated to register. Once you register CU Deals Pub, discover an account that have promo code RGSPRNG24RM and you will discovered a total out of $1,100000 or more inside being qualified direct dumps to your the newest checking membership within 3 months from membership starting. Top-rated casinos on the internet providing $5 dumps fundamentally do not restriction people which put low amounts. You might nonetheless enjoy your favourite game and money out your profits instead issues.

Normally, all of the money received, otherwise fairly expected to end up being obtained, inside taxation seasons up to and including the brand new date of deviation should be said to the Setting 1040-C, and the taxation involved have to be paid. When you shell out one taxation found since the owed on the Form 1040-C, and also you document all the output and you can pay-all taxation due to possess past years, might found a cruising otherwise deviation permit. However, the fresh Internal revenue service will get permit you to furnish a thread encouraging fee instead of paying the fees without a doubt ages.

Wages or other compensation repaid in order to a nonresident alien for characteristics performed while the an employee are usually susceptible to graduated withholding at the a similar rates while the resident aliens and U.S. owners. For this reason, your own compensation, except if it is especially excluded on the label “wages” for legal reasons, or perhaps is excused of taxation by the pact, is actually susceptible to graduated withholding. To the part of the year you’re an excellent nonresident alien, you’re taxed to the income away from You.S. offer and on certain foreign origin earnings handled since the effortlessly linked that have a great You.S. change otherwise company. The principles for treating overseas resource earnings as the efficiently connected are chatted about inside part 4 less than Foreign Income.

BC.Game ‘s the seller out of cryptocurrency gaming, offering more 150 cryptocurrencies, and one another Bitcoin and you may Ethereum. Crypto-partners are certain to get a great time with over ten,one hundred thousand online game readily available, and exclusives beneath the “BC Originals” branding. Their main places are pacey profits, an incredibly solid VIP program construction, and you will every day campaigns. Maybe not catering to antique a style of purchasing wagers, BC.Video game is fantastic for professionals that like a complete modern and you will crypto-friendly program. Deposit NZ$5 from the gambling enterprises inside my cautiously picked number for new Zealand participants and grow your playing balance having cash bonuses and you can totally free revolves!